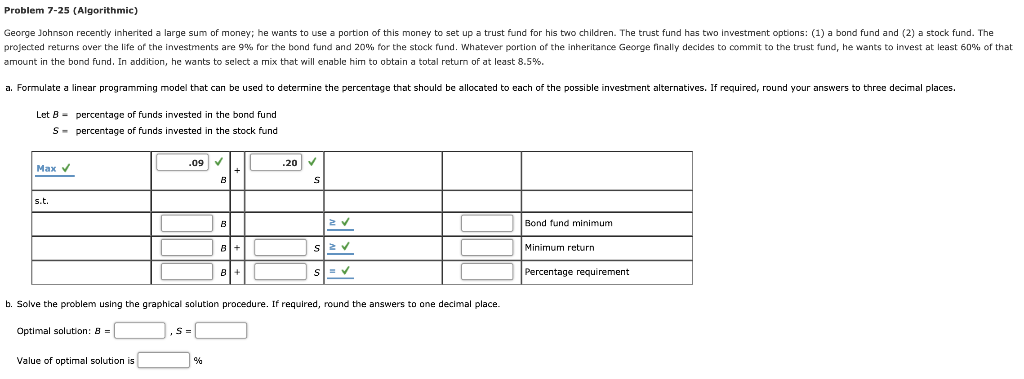

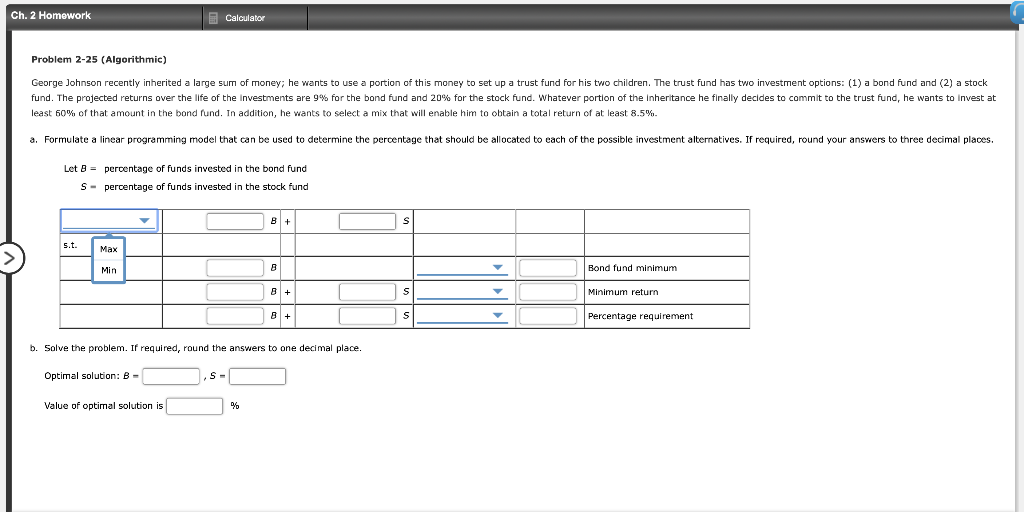

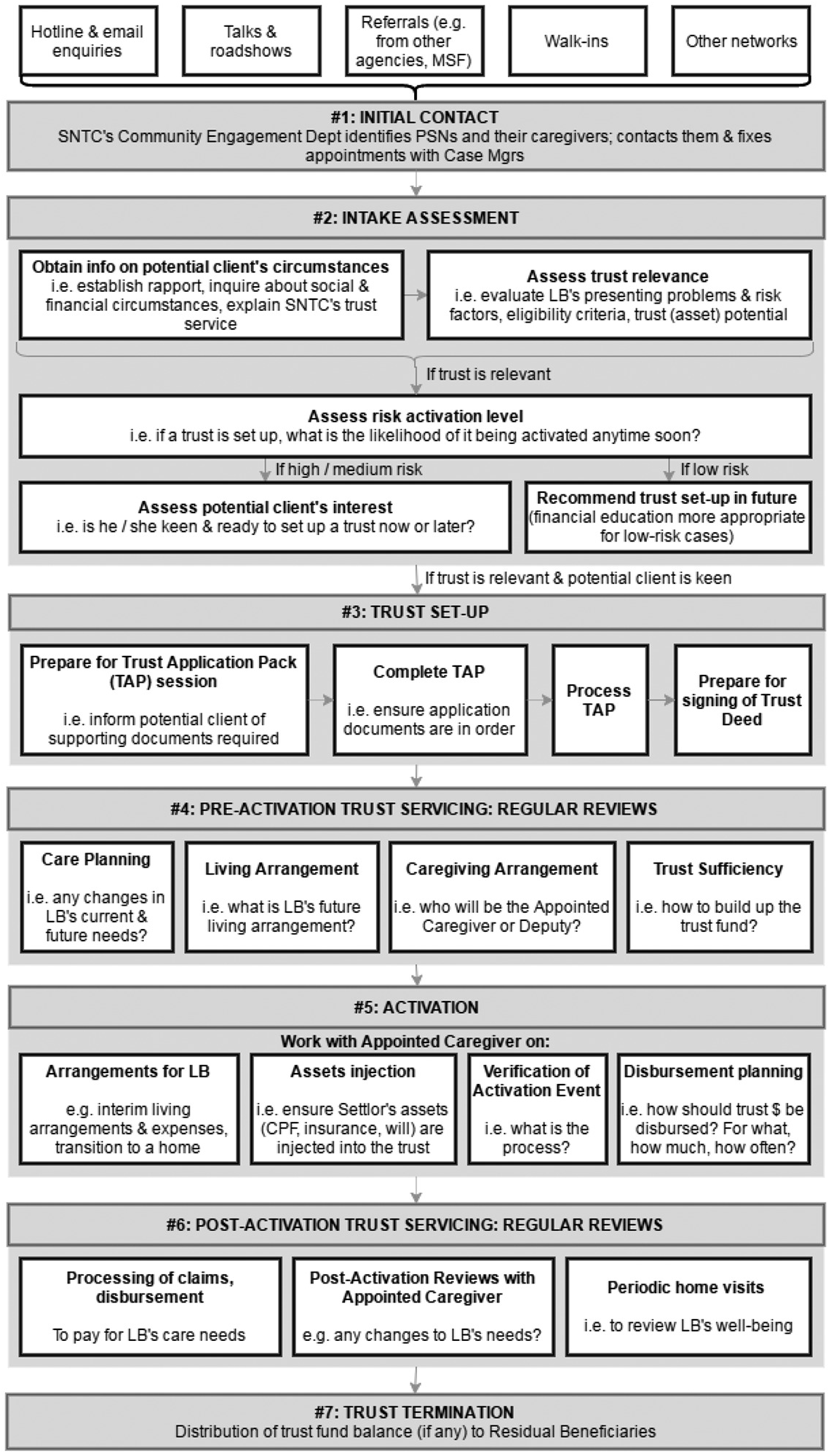

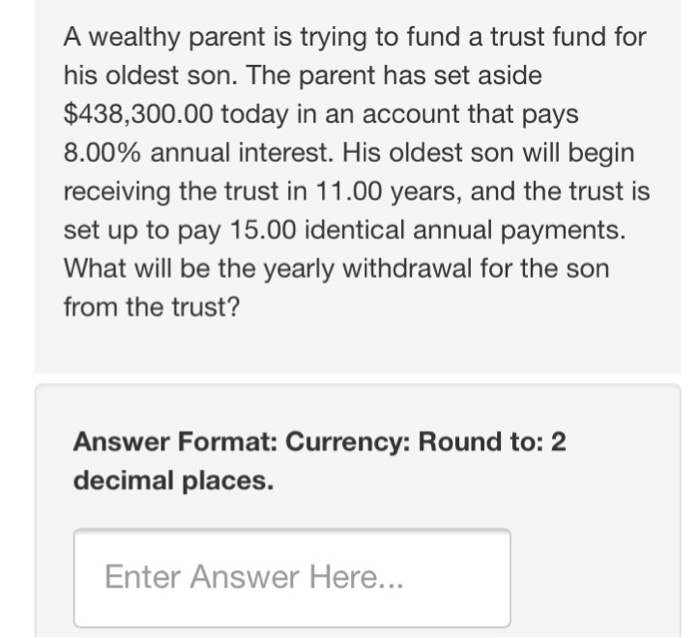

Before you set up a trust fund think about the purpose it will serve. A grantor is the person who establishes and puts assets into a trust fund.

Register your fund with the the irs.

How to set up a trust fund.

Choose the right type of trust.

Establishing a trust fund isnt as difficult as you think collect key details.

A trustee is the person who oversees and manages the assets in a trust fund.

There are revocable trusts and.

A trustee is a bank attorney or other entity set up for this purpose.

The next step in setting up a trust is going to an experienced.

Usually the trust.

Since the assets are no longer yours you dont have to pay income tax on any money made from the assets.

The person setting up a trust fund is known as the grantor while the person.

Find a reputable attorney.

Setting up a trust fund.

Setting one up can be complicated so you should have professional help.

Register the trust with the irs.

Steps to set up a trust fund.

Before we talk about how to set up a trust fund lets review a few key terms.

Once you place assets in the trust they are no longer yours.

A trust fund refers to a fund made up of assets such as stocks cash real estate mutual bonds paintings or antiques or even a business that are distributed after a death.

They are under the care of a trustee.

A trust is a useful estate planning tool for passing on assets that allows assets to be held by trustees for the beneficiaries.

Consider why you want to create a new legal arrangement to restrict.

No comments:

Post a Comment