Assets are then transferred into the trust to fund the trust. Oral trusts are valid in maryland but are very difficult to enforce and manage.

Heres how youll go about creating a living trust in the old line state.

How to set up a living trust in maryland.

Watch this video so you dont make the same 75000 mistake my grandma made.

The decision to use a revocable living trust in maryland is something that should be discussed with an experienced estate planning attorney.

Take inventory of your property.

Choose whether to make an individual or shared trust.

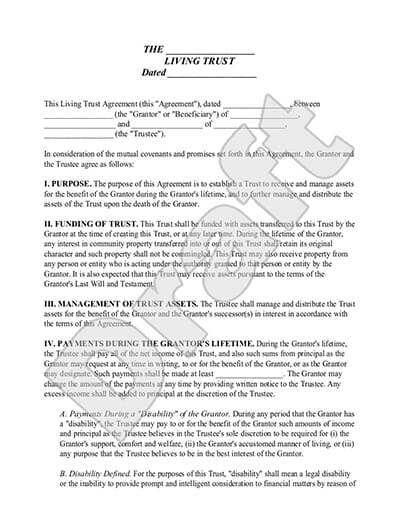

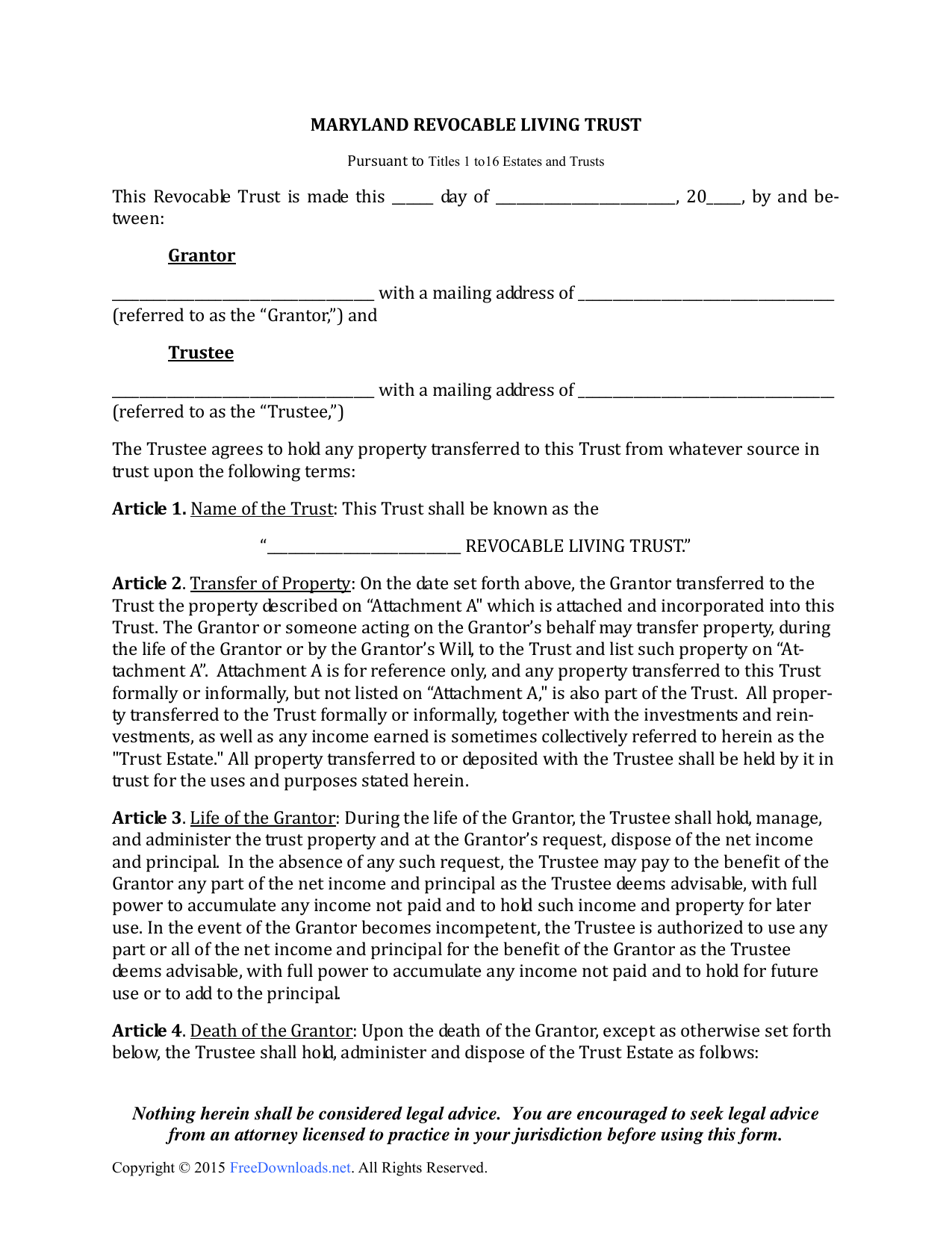

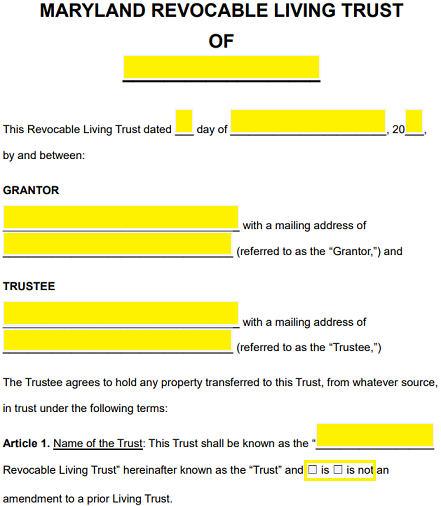

The maryland revocable living trust is a legal agreement formed by a person grantor for the purpose of placing property and assets into a separate entity with instructions for distribution after their death.

Setting up a living trust when it comes to estate planning will help you avoid costly probate and expensive attorney fees.

Confusing aspects of a revocable living trust.

Choose the type of trust you want.

Ask exactly what is included in the lawyers fee before you agree to work together.

You can store most of what you own including.

The concepts involved in the creation and the management of revocable living trust can be complicated.

The living trust process involves providing education on your various options completing a detailed fact finding interview with the attorney.

A revocable living trust is an option to consider as part of your overall estate planning.

If you are single its likely that a single trust will be the best option for you.

In addition a person who.

Avoiding the probate process in the state of maryland is the most obvious benefit of a revocable trust.

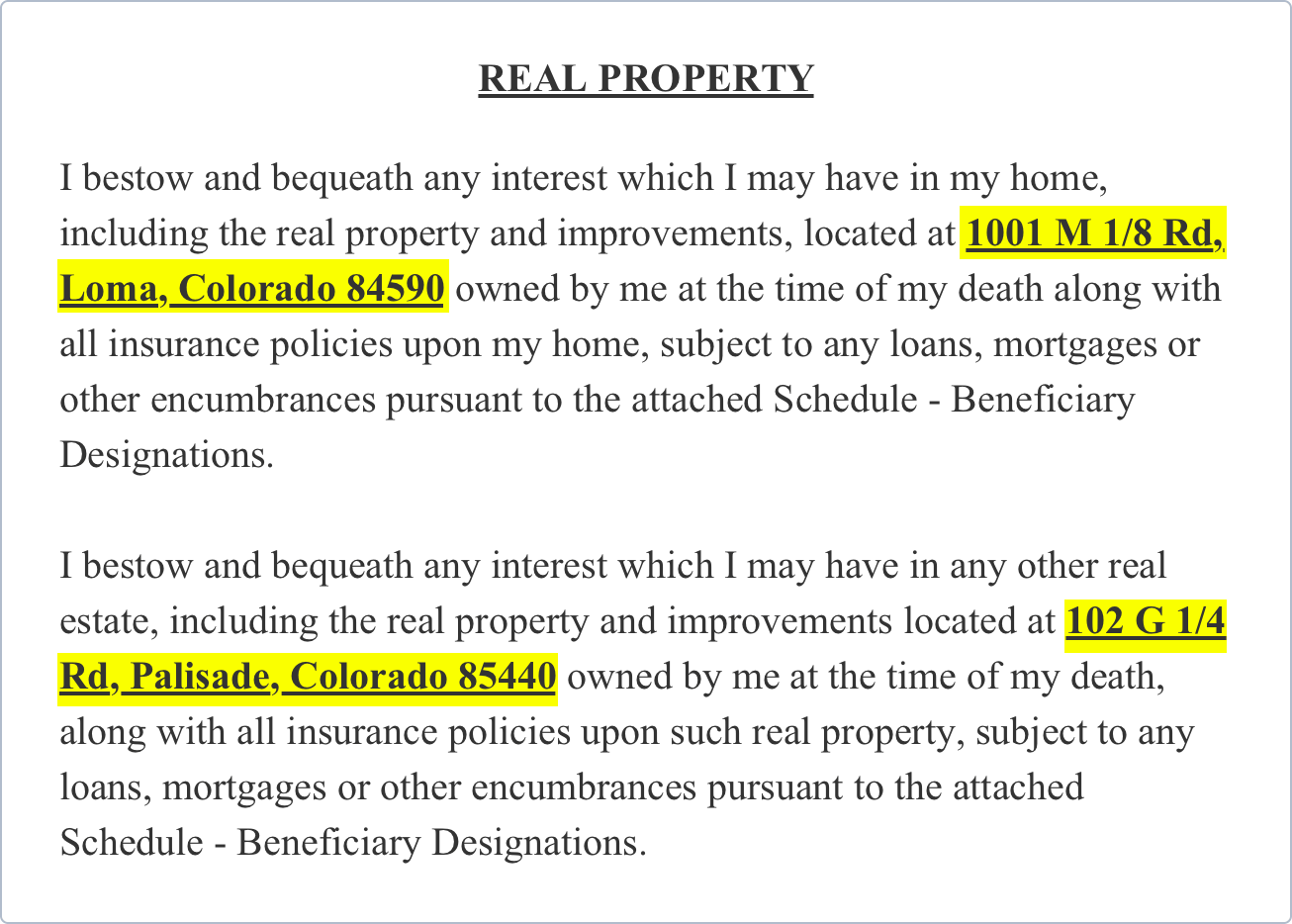

Decide what property to include in the trust.

Create the trust document.

Even if someone sets up a living trust he or she still must have a will to transfer any assets that have not been transferred to the trust prior to death.

Choose a successor trustee.

Also in some states such as florida a living trust must be executed with the same formalities and witnesses as a will.

You can make a living trust quickly and easily with nolos living trust or quicken willmaker.

You can get help from.

Decide who will be the trusts beneficiaries who will get the trust property.

If you hire an attorney to create your living trust she will likely create the trust as part of a comprehensive estate plan.

If youre married.

In order to have a quality living trust prepared that meets the goals you have for your estate and your heirs it should take about 10 hours in total time.

To create a living trust in maryland you create a declaration of trust which is a written document.

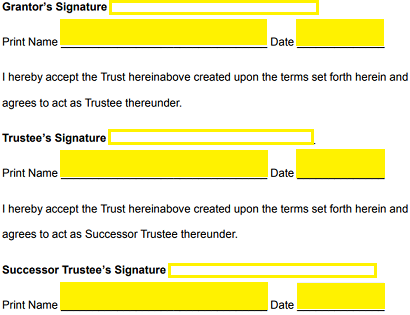

You sign the declaration in front of a notary public.

To make a living trust in maryland you.

Finally to make the trust effective all property to be distributed under its terms must be transferred into the name of the trustee using a deed or other standard transfer document.

To fully achieve all necessary protections you need a will powers of attorney and health care directives in addition to your living trust.

Once the trust is drawn up you sign it in front of a notary public.

No comments:

Post a Comment